By: Michael Wang at Congero Technology Group 11/17/2023

Services Billing Overview: Streamlining Financial Operations in the Digital Age

In the ever-evolving landscape of digital services, the billing process plays a pivotal role in ensuring seamless financial transactions. John’s journey with T-Mobile serves as a compelling narrative, shedding light on the intricacies of billing, from credit checks to partnership settlements.

After moving into a new home, John went to T-Mobile for a 5G home internet plus wireless services bundle. By following a standard process, a T-Mobile staff requested his personal minimum identifiable information for credit checking. The system initiated a request to one of the three major credit bureaus, say, Equifax, to obtain John’s creditworthiness, which qualified John for getting the services, plus a brand-new iPhone, without any down payment. John requested an additional North America roaming plan, as he needs to travel to Canada and Mexico. Then the next month, he made a trip to Mexico and enjoyed the fully available wireless service via one of T-Mobile’s international roaming partners, Telefonica.

Business as usual, services are provided with costs, which are billed by service providers. Even before John received the wireless services, his credit checking triggered a request from T-Mobile to Equifax, and the corresponding credit reporting transaction was included on the next monthly bill from Equifax to T-Mobile.

At the end of the first month, T-Mobile billed John for the monthly service fees, which included domestic cellular service and wireless internet services. In addition, for his new iPhone, the monthly installment amount was also added to the bill.

The next month, as John used Telefonica roaming services in Mexico, the partnership billing/settlement between Telefonica and T-Mobile also included John’s roaming usage.

Now we can see that routine and normal daily-life activities trigger different types of back-office financial activities, particularly billing, or, in a broader term, monetization.

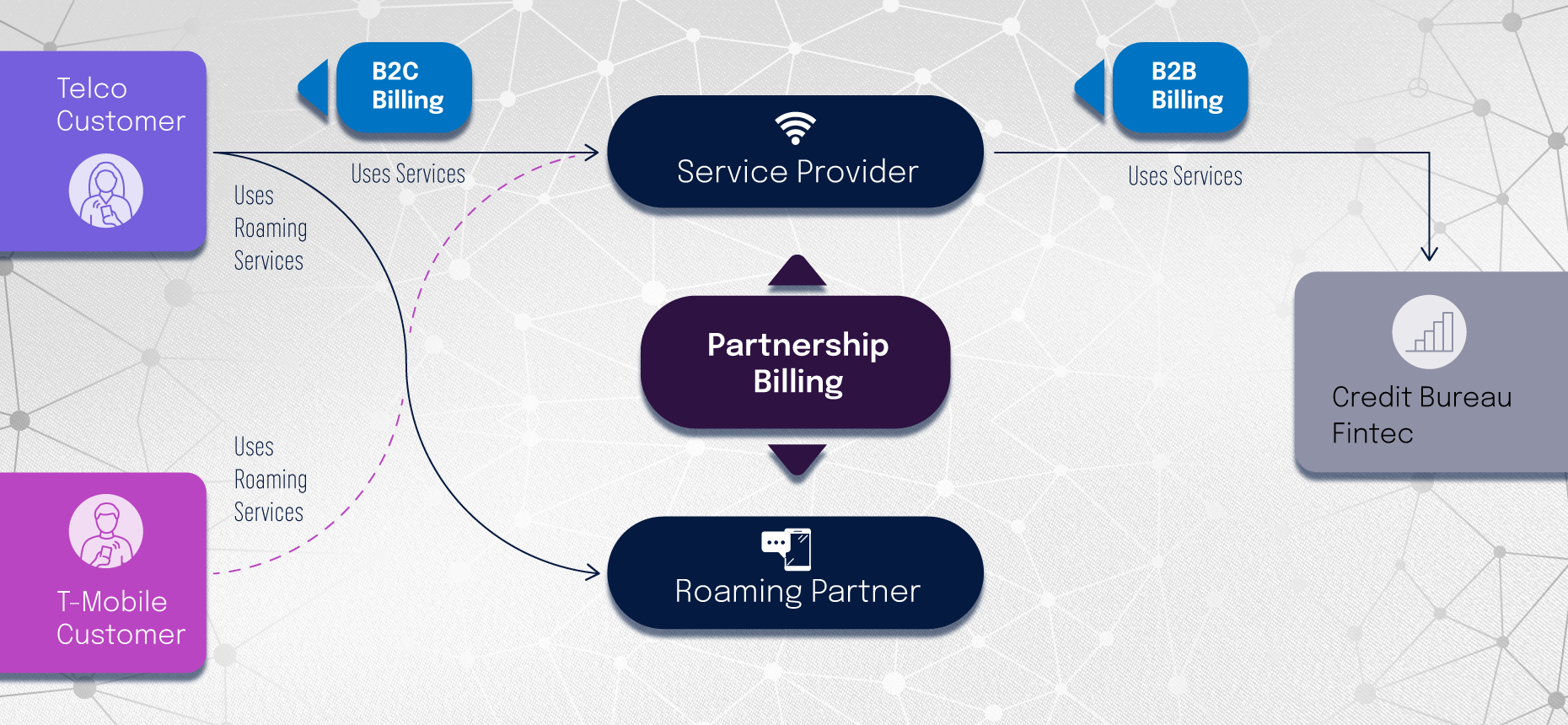

John’s short story touched on the categories of B2C billing vs. B2B billing, as well as partnership billing & settlement, as depicted in the following.

- B2C billing, the most common type of billing, refers to Business billing Consumers for goods and services. From the monetization point of view, there are three major types of changes to be billed.

- Item Charge: usually one-time purchase of goods, or equipment set-up fees. John’s newly acquired iPhone is billed as an item charge, although he chose to pay over some time via multiple installments.

- Usage Charge: John’s daily usage, phone calls, and internet activities, measured by time of volume, are billed as usage charges.

- Subscription Charge: recurring fees, monthly, quarterly, annually, etc., often offered as a plan to cover a specified amount of usage within a billing cycle.

- B2B billing refers to a Business billing another Business entity for goods and services. In John’s credit checking case, Equifax bills T-Mobile for consumer credit reporting.

- Partnership billing or Settlement, usually for two partner businesses to settle service charges from each other. This is when the two partners, or end consumers of the two partners, utilize services from each other. In John’s story, as a T-Mobile customer, he used Telefonica service, which is added to the B2B bill from Telefonica to T-Mobile. At the same time, Telefonica customers are likely roaming on T-Mobile’s network, with charges included in the bill from T-Mobile to Telefonica. For simplicity, let’s say, for January, T-Mobile has 2 million-dollar charges for Telefonica, and Telefonica has a 1.5 million-dollar charge for T-Mobile. Instead of paying each other millions of cash, they can settle the bill on the 0.5 million-dollar delta amount.

Although each business has its billing nature, an enterprise is not limited to just one type of billing. For example, John may check his creditworthiness directly from Equifax, and Equifax ends up billing John directly, via a B2C billing platform. As the business processes and business policies are different, a company may end up maintaining two billing platforms, one for B2B billing, and another for B2C billing.

T-Mobile in this example, may have a reasonably large group of business customers as well. That leads to T-Mobile having both B2B billing and B2C billing, plus partnership billing with roaming partners.

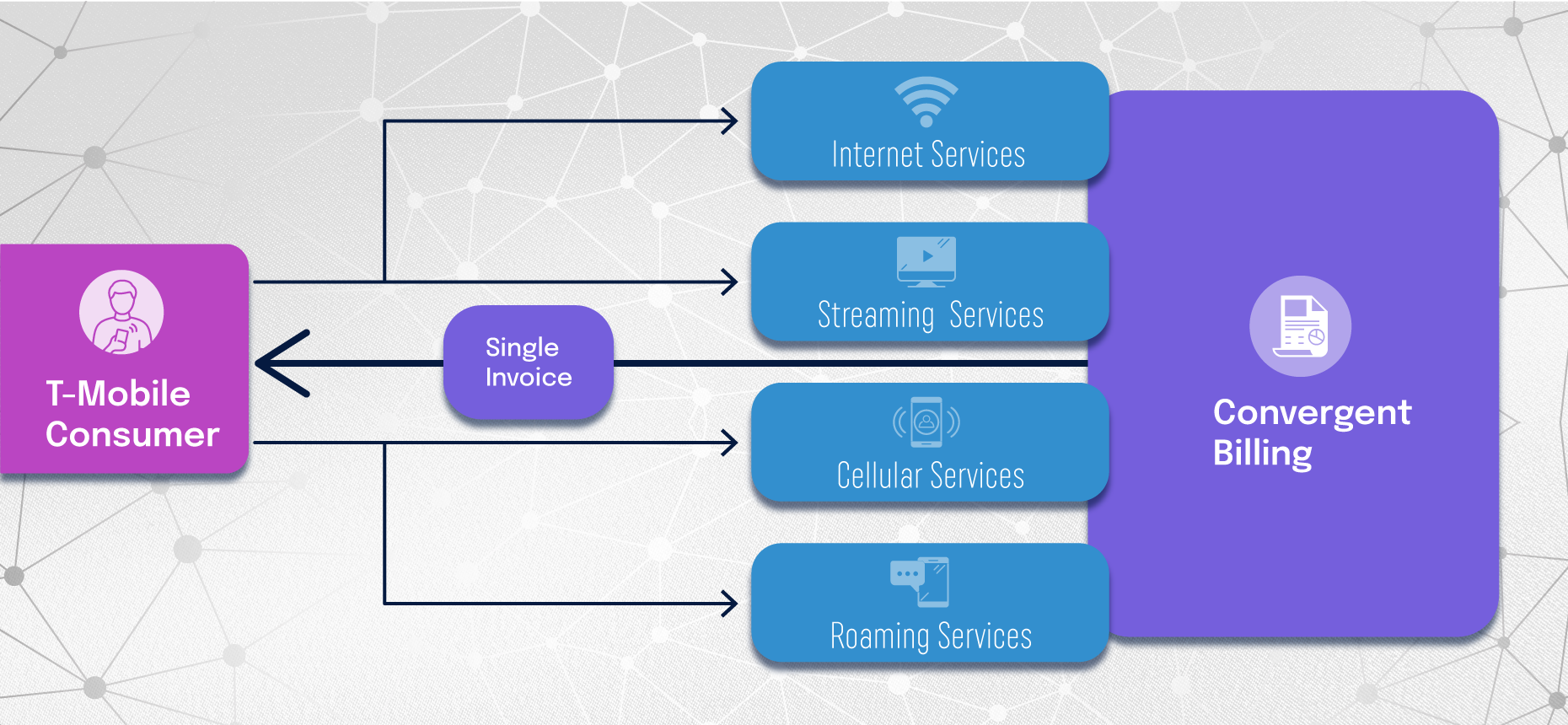

Traditionally, a B2C billing platform operates on a specific line of service. For example, a communications company may have three billing platforms running, one producing monthly invoices for telephone services, the second one billing for broadband internet services, and another one for media streaming services. That is, customers who subscribe to all three services receive three invoices per month, and they are expected to make three payments per month, which is not an optimal practice.

One straightforward solution is to consolidate all service charges, from multiple lines of services, into a single monthly bill. That leads to convergent billing, which has been more and more adopted by many companies in recent years. A sample convergent billing platform is depicted below.

While it is a big challenge for a company to merge multiple billing systems into a single convergent billing platform, it does help the company stay competitive with the capability of offering across-line-of-service bundles with discounts. As shown in the above diagram, a convergent billing platform can enable T-Mobile to offer existing wireless customers new 5G internet services plus Netflix Streaming services, with competitive discounts against its peers in the industry.

Facing technological challenges and capitalizing on strategic opportunities is crucial for business success. Are you ready to propel your company toward a more profitable and efficient future?

Join our LinkedIn network and share your thoughts.

0 Comments